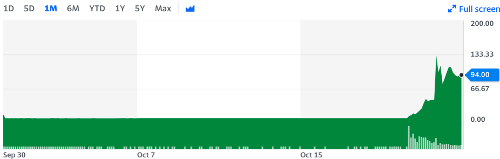

Take a look at this chart…

This is a chart of Digital World Acquisition Corp. (NASDAQ: DWAC), a technology and financial services SPAC that blew through the roof last week after it was announced it would be taking Donald Trump’s planned social media platform public.

The stock gained more than 120% in a single day.

No matter how you feel about Trump, the bottom line is that this guy has a lot of fans and the Trump brand can still put asses in seats. That chart is proof of his influence.

Make no mistake: The trading action we saw on DWAC last week was the result of the Trump name and that name being promptly promoted on social media networks. It was not the result of careful analysis or due diligence. If it were, it’s unlikely the stock would’ve moved at all.

Truth is, even if you think Donald Trump was the greatest president the U.S. has ever had, his track record on taking companies public is not a good one. In fact, the last time Trump took a company public, it ended up being a miserable failure for shareholders.

Dan Alexander from Forbes summed up that debacle pretty well when he wrote about Trump’s previous public company, Trump Hotels and Casino Resorts, which was listed on the New York Stock Exchange under the symbol “DJT.”

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

Check it out:

Trump Hotels and Casino Resorts started with just one Atlantic City casino, but Trump personally held another two outside of the firm. Less than a year after taking the company public, he used it to buy one of his two other casinos, the debt-burdened Taj Mahal, in a deal that valued his stake at $40.5 million. The transaction improved Trump’s personal balance sheet, but the company suddenly had a disastrous amount of debt.

As part of the agreement, Trump also collected $51 million of cash and $11 million of stock, in exchange for land that he had previously rented to the company for about 5% of that price annually. A couple of months later, Trump Hotels and Casino Resorts announced that it was going to pony up roughly another $500 million for Trump’s third Atlantic City casino. At the time, one analyst estimated that the property was worth more like $400 million, suggesting Trump was essentially robbing the public company of $100 million. Investors smelled a rotten deal, and shares plummeted 37% within days.

In 1998, Trump treated himself to two personal loans from the company, taking out $11 million in one instance and $13.5 million in another. Trump Hotels and Casino Resorts racked up an estimated $13 million of expenses for things like entertaining at other Trump properties, using Trump’s personal planes and leasing space inside Trump Tower. Trump also collected lots of fees. He had one agreement that paid him based on the performance of a particular casino, but according to the deal, Trump had to “promptly” pay back the money if things went south. Things did go south, but Trump kept the $1.3 million. The publicly traded company eventually ended up crediting the missing funds against later earnings. In a different example, a separate Trump company collected $1.3 million as part of a “services agreement.” According to a document filed with the Securities and Exchange Commission, however, Trump’s separate company was “not required to devote any prescribed time to the performance of its duties” in order to collect the money. Such nickel-and-dime machinations added up. From 1995 to 2004, Trump personally received an estimated $50 million in fees, salaries, rents and so forth. Over that same stretch, the company lost $647 million. In 2004, it declared bankruptcy.

Look, you may be the biggest Trump supporter in the world, but that doesn’t change the fact that from a historical perspective, his track record with public companies isn’t so hot.

His track record with private companies isn’t so hot either. Trump University, Trump Steaks, the Trump Shuttle airline. These were all huge disasters, and his social media company will be no different.

The new social media network is called Truth Social, but I don’t believe it has any chance of becoming even remotely competitive with Facebook or Twitter.

By limiting its scope to primarily Trump supporters (because non-Trump supporters will never use this site), it will never be able to see the kinds of numbers Facebook and Twitter can pull in. This isn’t a criticism of the site itself, by the way, but rather an observation of truth.

Sure, it might be fun to entertain conversations with like-minded folks on the platform, but its ability to reward shareholders is unlikely. Between the platform’s inability to reach folks who aren’t either conservatives or Trump supporters and Trump’s historical record of business failures, I see DWAC being little more than a short-lived trading opportunity.

Of course, if you’re a day trader, have at it. Hell, I might even play with this one a little too. But in terms of a solid, long-term, sustainable investment, DWAC will prove to be a giant disappointment.

To a new way of life and a new generation of wealth…

Jeff Siegel

Jeff is an editor of Energy and Capital as well as a contributing analyst for New World Assets.

Want to hear more from Jeff? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

@JeffSiegel on Twitter

@JeffSiegel on Twitter